The Ultimate Guide to Online Trading

Introduction

In today’s digital era, online trading has emerged as a revolutionary gateway for individuals to directly engage with the stock exchange, online commodity trading, and various financial instruments. The advent of the internet and sophisticated trading platforms has democratized access to global markets, allowing traders from all corners of the world to buy and sell assets with just a few clicks.

This ease of access has significantly contributed to the growing popularity of online trading, making it an attractive venture for both novice and experienced investors alike.

However, as enticing as it may seem, online trading is not without its complexities. The volatile nature of financial markets requires a well-informed approach to navigate successfully. Before diving into the world of online trading, understanding the fundamentals and developing effective trading strategies are paramount. Knowledge about market trends, analysis techniques, and the ability to read financial statements can immensely impact one’s trading decisions, potentially leading to more informed and, hopefully, profitable outcomes.

Equipping oneself with this knowledge not only mitigates the risks associated with online trading but also enhances the chances of success. Also, staying updated with the latest trends and strategies becomes increasingly crucial:

A well-prepared trader is one who stands the best chance at harnessing the potential of online trading for financial empowerment.

Back to Basics: Understanding Online Trading

Online trading is a financial strategy that involves buying and selling financial instruments through an internet-based trading platform. These platforms are provided by brokers and are available to anyone wishing to profit from the market.

The evolution of online trading platforms has been nothing short of revolutionary. Initially, trading was conducted over the telephone or in person, which was not only time-consuming but also limited the trader’s ability to act quickly on market changes. The introduction of the internet and development of online trading platforms has democratized access to the financial markets, making it possible for individuals to trade from anywhere in the world, allowing for the execution of trades at virtually any time of the day, and on every available market.

Simply put, the process starts with traders opening an account with an online broker, depositing funds, and then using the broker’s platform to place trades based on their analysis of market movements. The most common types of trading include:

- Stocks exchange: Shares in the ownership of companies, which can be bought or sold on various stock exchanges.

- Forex Trading (Foreign Exchange Market): The trading of currencies against one another, which is particularly popular due to its high liquidity and 24/5 operating hours.

- Online commodities trading: Involves trading physical goods such as gold, oil, and agricultural products. It can be done through futures contracts to speculate on price changes.

- Cryptocurrency trading: The newest addition to online trading, allowing for the buying and selling of digital currencies like Bitcoin and Ethereum.

These platforms have continuously evolved, offering more sophisticated tools for analysis, risk management, and automated trading. Today, traders can enjoy features like advanced charting capabilities, economic indicators, and real-time data feeds, which were once available only to professional traders in financial institutions.

This digital transformation has significantly lowered the barriers to entry for trading, opening the financial markets to a broader audience. However, it has also emphasized the need for education and informed decision-making in what is an increasingly complex and fast-paced arena.

Safety in Online Trading

The convenience and accessibility of online trading come with their own set of security challenges. As traders engage with platforms to execute transactions, they become targets for various security threats. Understanding the common threats is the first step toward securing one’s investment and personal information:

One prevalent threat in the online trading world is phishing attacks, where scammers trick individuals into giving away sensitive information like login credentials through fake emails or websites that mimic legitimate platforms.

Another significant risk is the presence of malware and ransomware, which can infiltrate systems to steal data or lock users out of their accounts, demanding payment for access restoration.

Recognizing these threats involves being vigilant about the sources of emails and the authenticity of websites. Traders should always check the URL of their trading platform to ensure it starts with “https,” indicating a secure connection, and be wary of unsolicited communications requesting sensitive information.

To safeguard online trading accounts, here are essential tips every trader should follow:

- Use Strong Passwords and Two-Factor Authentication (2FA): Strong, unique passwords combined with 2FA add an extra layer of security, making it harder for unauthorized users to gain access.

- Keep Software and Platforms Updated: Regularly updating trading software and apps ensures that security patches are applied, protecting against vulnerabilities.

- Utilize Secure and Private Networks: Avoid using public Wi-Fi for trading activities. Instead, opt for a secure, private network and consider using a VPN for an added security layer.

- Regularly Monitor Accounts: Keep an eye on account activity and statements to quickly identify and report any unauthorized transactions.

But most importantly, selecting a regulated and reputable trading platform is paramount to ensuring safety in online trading. Regulatory bodies oversee the operations of these platforms, ensuring they adhere to strict standards and practices designed to protect traders. Reputable platforms invest heavily in cybersecurity measures to guard against data breaches and offer customer support for resolving potential security issues.

Traders should conduct thorough research before selecting a platform, verifying its regulatory status, and reading reviews from other users. This diligence not only contributes to the security of one’s investments but also ensures a trading environment that upholds fairness and transparency.

Getting to Know Your Online Trading Platform

The MetaTrader platform stands out as a pivotal tool in the world of online trading. Renowned for its advanced technical analysis capabilities, automated trading robots (Expert Advisors), and customizable trading system, MetaTrader caters to both novice and experienced traders.

It comes in two variations: MetaTrader 4 (MT4), which focuses on forex trading, and MetaTrader 5 (MT5), offering additional features including trading in stocks exchange and online commodities trading.

What sets MetaTrader apart is its user-friendly interface combined with powerful analytical tools. It includes over 50 built-in indicators and tools to help traders analyze market trends and forecast potential movements more accurately. Furthermore, its MQL language allows for the creation of custom indicators and strategies, providing traders with the flexibility to tailor their trading experience.

Security is also a key feature of the MetaTrader platform, offering encrypted data exchange between the client and server, alongside support for two-factor authentication to protect account access. Its widespread adoption by brokers worldwide is a testament to its reliability and effectiveness as a trading platform, making it an excellent choice for anyone looking to dive into online trading.

Top of Form

Risks Associated with Online Trading

Online trading, while offering substantial profit potential, is fraught with various risks that traders must navigate wisely. Market risk and volatility are at the forefront, where the value of investments can fluctuate widely due to economic changes, political events, or market sentiment shifts. These unpredictable swings can drastically affect trade outcomes.

Another significant concern is the risk of leverage and margin calls. Leverage allows traders to open larger positions than their actual capital would permit, amplifying both gains and losses. A margin call occurs when the account balance falls below the required level, forcing traders to deposit more funds or close positions, potentially at a loss.

Psychological factors also play a critical role, as emotional trading can lead to rash decisions and significant financial losses. The thrill of winning or the panic of losing can cloud judgment, pushing traders away from their strategic plans.

Online trading also encompasses various legal risks that traders must be aware of. Regulatory compliance issues can arise, as different countries have unique laws governing trading activities, including tax obligations and reporting requirements. Additionally, traders may face the risk of engaging with unregulated or fraudulent platforms, leading to potential legal entanglements or the loss of investments.

Managing and mitigating trading risks involves a disciplined approach. Diversification, or spreading investments across various assets, can reduce market risk. Setting stop-loss orders helps manage losses, and understanding leverage’s implications is crucial to avoid excessive debt.

Finally, maintaining a level head and sticking to a well-researched trading plan are key to overcoming the emotional challenges of trading. Adopting these strategies can help traders navigate the complexities of the online trading landscape with greater confidence and control.

Opportunities in Online Trading

The dynamic landscape of online trading offers a spectrum of opportunities for investors and traders, ranging from long-term investment strategies to the fast-paced world of day trading. Long-term investment involves holding assets like stocks, bonds, or mutual funds for extended periods, capitalizing on the principle of compounding returns and market growth over time. This approach is well-suited for those seeking to build wealth steadily, with less exposure to the volatility of daily market fluctuations.

Conversely, day trading caters to those looking for quicker, more active trading opportunities. It involves buying and selling financial instruments within the same trading day, capitalizing on short-term market movements. This requires a keen understanding of market trends, a solid strategy, and the ability to act swiftly.

One of the most compelling advantages of online trading is quick access to global markets. Traders can easily invest in international markets, diversifying their portfolio beyond local offerings. This accessibility also means that traders can react in real-time to global economic news and market changes, potentially maximizing their returns.

Moreover, the rise of emerging trends and markets presents new opportunities. Cryptocurrency trading, for instance, has introduced a novel asset class that has attracted significant attention for its volatility and growth potential.

Similarly, Environmental, Social, and Governance (ESG) investing has gained momentum, allowing traders to invest in companies that align with their values regarding sustainability and ethical practices. These trends not only diversify the trading landscape but also highlight evolving investor priorities and the potential for innovative investment strategies.

Educating Yourself for Success

Continuous learning and staying informed are crucial, as the financial markets are dynamic and influenced by a myriad of factors, from geopolitical events to economic indicators.

Traders have at their disposal an array of resources to aid in their decision-making process. They can follow us on social media and subscribe to our daily reports, trade analytics, market insights, and in-depth articles. Leveraging these educational resources equips traders with the knowledge to make informed decisions, adapt to market changes, and ultimately, achieve their trading objectives.

Also, real-time economic figures provide valuable information to navigate the markets effectively. Moreover, developing a robust trading strategy and plan is essential, grounded in the knowledge gained from these resources. It allows traders to approach the market with confidence, set realistic goals, and manage risk efficiently.

Conclusion

In conclusion, the journey into online trading is one filled with potential and opportunity, yet it requires a keen awareness of safety, thorough research, and continuous education.

We’ve explored the essential steps to safeguard your investments, the significance of staying informed through market analysis and educational resources, and the critical role of developing a sound trading strategy. When considering online trading, we encourage you to approach it with caution and informed decision-making.

We invite you to explore more resources available on our website and our social media platforms. Whether you’re looking for advanced strategies, market insights, or practical tips, our platform is designed to support your trading journey.

Moreover, we encourage you to engage with our team of experts for personalized inquiries. Your success in online trading is a journey we are committed to supporting, every step of the way.

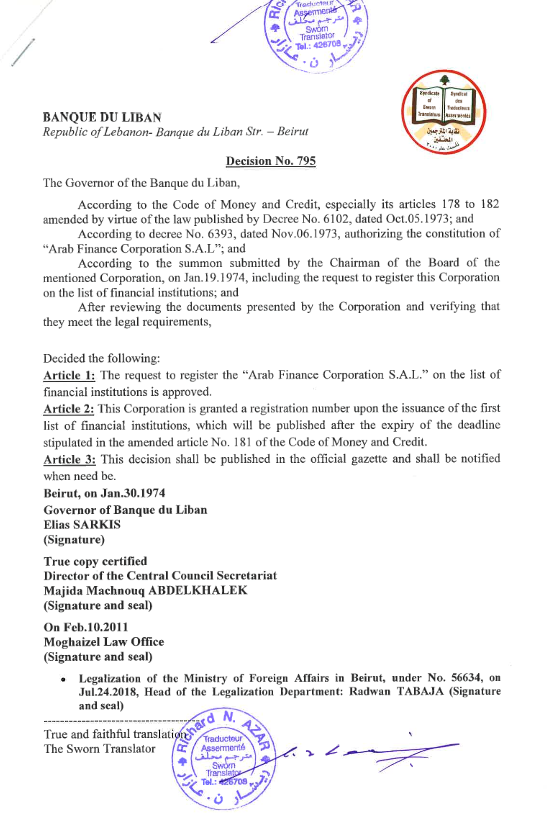

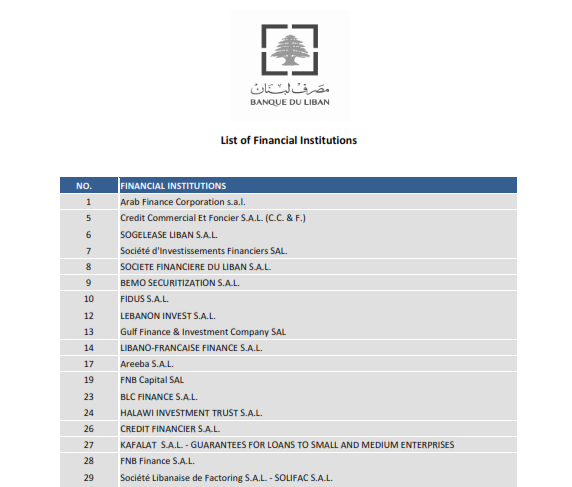

Discover How We Can Help You Grow

Established in 1974, Arab Finance Corporation (AFC) is the first financial institution registered in Lebanon. We hold the number one on Banque du Liban’s list of financial institutions. For half a century now, we have been offering a wide range of financial services to private and institutional clients in Lebanon, the region and worldwide. Our services range from financial markets and corporate finance advisory to asset management and online trading services.