How to Trade the Stock Market? Essential Insights for First-Time Traders

Introduction

Stock trading has become an integral part of the global economy, offering individuals and institutions the opportunity to partake in the financial growth of companies while achieving personal financial goals. The allure of the stock market, with its promise of substantial returns, draws in myriad investors each year.

Economic factors such as low interest rates, market volatility, and economic downturns or booms can also influence trading behavior and outcomes. During the COVID-19 pandemic, many individuals turned to the stock market as an alternative income sources, with nearly 55% of them being first-time investors, according to a global study.

This article aims to simplify the complexities of stock trading for beginners, offering a clear and comprehensive guide to entering the world of stocks.

“As we navigate the complexities of the financial markets, our goal at AFC is to empower our clients with the knowledge and tools necessary for successful investing. We believe that a well-informed investor is a successful investor. Understanding the stock market isn’t just about making profits; it’s about making smart, educated decisions that align with your financial goals.” – Emile Mehanna, CEO, AFC.

Understanding Stocks and Stock Trading

At its core, a stock is a type of security that signifies ownership in a corporation and represents a claim on part of the corporation’s assets and earnings. There are two main types of stock: common and preferred. Common stock usually entitles the owner to vote at shareholders’ meetings and to receive dividends. Preferred stockholders generally do not have voting rights but have a higher claim on assets and earnings than the common stockholders.

Stock trading involves the buying and selling of these stocks among investors through stock exchanges or over-the-counter markets. The primary goal of trading stocks is to profit from capital gains, which occur when the price of a stock increases above the purchase price, and from dividends, which are earnings distributed to shareholders from the company’s profit.

How the Stock Market Works

The stock market is a complex system where shares of publicly listed companies are issued and traded. Its origins can be traced back to the 17th century when the first stock exchange was established in Amsterdam. Today, major stock exchanges include the New York Stock Exchange (NYSE) and the NASDAQ in the United States, alongside prominent markets in China, such as the Shanghai and Shenzhen stock exchanges, and in Europe like the London Stock Exchange.

As a matter of fact, Chinese stock markets have seen exponential growth, with the Shanghai Stock Exchange’s market capitalization increasing by over 300% in the past ten years.

These exchanges act as managed auction markets where buyers and sellers come together to trade during specific hours known as market hours. Understanding these trading sessions is crucial as they dictate the liquidity and volatility of stocks.

As of the latest figures, over 630,000 transactions occur on the NYSE daily, demonstrating the vast scale and activity level of major stock exchanges.

The combined market capitalization of listed companies on the NASDAQ and NYSE exceeds $40 trillion, highlighting the immense value and influence of the U.S. stock markets globally.

Types of Stock Traders

The stock market accommodates various trading styles, primarily categorized into day trading, swing trading, and long-term investing. Day traders capitalize on small price movements within a single trading day. Swing traders, on the other hand, hold positions for several days to weeks to benefit from expected upward or downward shifts in price. Long-term investors may hold stocks for years, focusing on the companies’ potential for growth and sustainability over time.

Each style uses different methodologies for selecting stocks. Technical analysis involves studying charts and historical data to predict future price movements. Fundamental analysis, conversely, looks at economic and financial factors, such as the health of the economy and company performance. Some traders use a blend of both to inform their trading decisions.

In a recent study conducted in the US, but we’re seeing the same trend everywhere else, the demographic profile of stock investors has shifted, with nearly 20% of all U.S. stock market investors in 2021 being under the age of 35, up from 13% in 2018, indicating a growing interest among younger generations.

How to Start Trading Stocks

The first step in trading stocks is to open a trading account with a reputable broker. It’s vital to select a broker that not only offers low transaction fees but also provides personalized advisory services and robust customer support.

Once the account is set up, traders should educate themselves on the basics of stock charts and fundamentals. This includes understanding indicators like price trends, stock volume, and other analytical tools to help gauge market sentiment.

The rise of mobile trading platforms has led to increased market access, with over 60% of young investors primarily using smartphones or tablets for their trading activities.

Common Terms in Stock Trading

To effectively communicate and understand the nuances of stock trading, it is important to be conversant with its terminology. The basic key terms include:

- Bid: The highest price a buyer is willing to pay for a stock.

- Ask (or Offer): The lowest price at which a seller is willing to sell a stock.

- Spread: The difference between the bid and the ask price.

- Volume: This refers to the number of shares or contracts traded in a security or an entire market during a given period.

- Bull Market: A market condition where prices are rising or are expected to rise.

- Bear Market: A market condition where prices are falling or are expected to fall.

- Dividend: A portion of a company’s earnings distributed to shareholders.

- Market Order: An order to buy or sell a stock immediately at the best available price.

- Limit Order: An order to buy or sell a stock at a specific price or better.

- Stop Loss Order: An order placed to sell a security when it reaches a certain price, used to limit an investor’s loss on a security position.

- IPO (Initial Public Offering): The process through which a private company becomes publicly traded by offering its stocks to the public for the first time.

- Short Selling: The practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (“covering”). The aim is to profit from a decline in the price of the assets.

- ETF (Exchange Traded Fund): An investment fund traded on stock exchanges, much like stocks, which holds assets such as stocks, commodities, or bonds.

- Liquidity: The degree to which an asset or security can be quickly bought or sold in the market without affecting the asset’s price.

Risks and Rewards of Stock Trading

A primary reason many individuals trade stocks is the potential for wealth accumulation. According to a survey by the Motley Fool, over 70% of respondents listed building long-term wealth as their main incentive for investing in the stock market.

Many investors trade stocks to diversify their investment portfolios. According to a report by Vanguard, diversification helps reduce risk and is a major reason why investors choose stocks over other forms of investments.

Investing in the stock market is not without risks, which include market volatility and the potential for losing money. However, the rewards can be significant, including capital gains and dividend income.

Adopting a disciplined approach to risk management, such as setting stop-loss orders and diversifying a portfolio, can help mitigate these risks.

Additional Resources for Learning

For those new to stock trading, continuous education is vital. Numerous resources are available, from books and online courses to seminars and webinars, which can provide deeper insights into market strategies and trends. Practicing with simulators and demo accounts can also be beneficial, offering a risk-free way to hone one’s trading skills.

Trading in the stock market requires patience, dedication, and a methodical approach to both education and execution. As you begin your trading journey, consider each decision carefully and always strive to expand your knowledge and skills. We encourage you to explore further articles and resources on our website and share this knowledge with others who may also be interested in the dynamic world of stock trading.

“As we look to the future, the landscape of stock trading continues to evolve, bringing new opportunities and challenges. At AFC, we are committed to guiding our clients through these changes with expertise and insight. We encourage all aspiring traders to approach the market with curiosity, caution, and a commitment to continuous learning. Remember, the journey to financial independence through the stock market is a marathon, not a sprint.” – Emile Mehanna, CEO, AFC

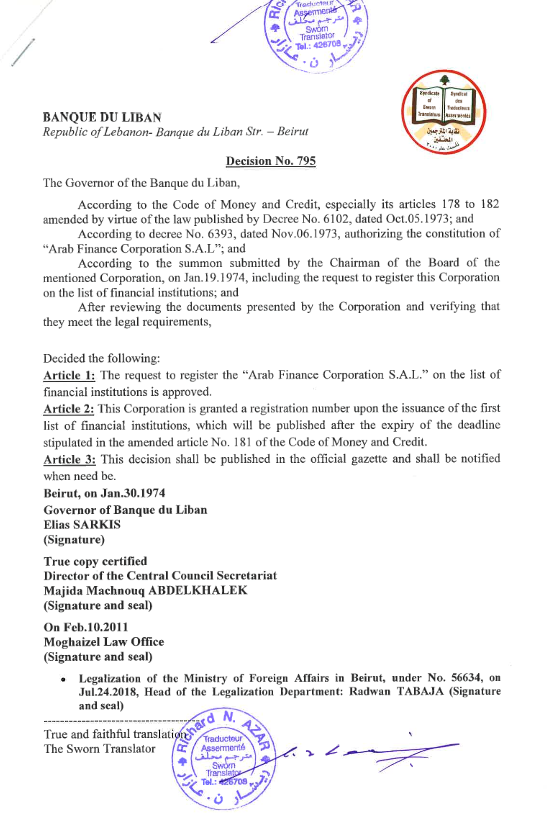

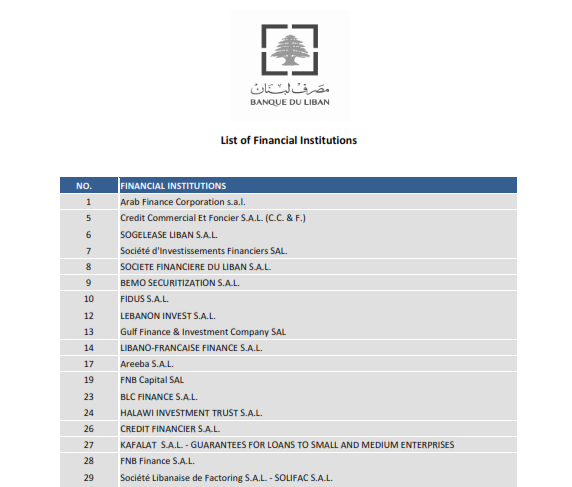

Discover How We Can Help You Grow

Established in 1974, Arab Finance Corporation (AFC) is the first financial institution registered in Lebanon. We hold the number one on Banque du Liban’s list of financial institutions. For half a century now, we have been offering a wide range of financial services to private and institutional clients in Lebanon, the region and worldwide. Our services range from financial markets, corporate finance advisory, asset management, to online trading services.