Why Do You Need Wealth Management

In today’s complex financial landscape, managing wealth effectively is more important than ever. Whether you’re planning for retirement, looking to preserve your estate for future generations, or simply trying to make informed financial decisions, wealth management is key. This comprehensive approach to financial services goes beyond basic financial planning, encompassing a range of services such as investment management, tax planning, and private banking. We’ll explore why wealth management is crucial and how it can help you achieve your long-term financial goals.

What is Wealth Management?

Wealth management is a holistic approach to financial planning that integrates various financial services into a cohesive strategy tailored to an individual’s needs. It typically involves a wealth manager or financial advisor who coordinates the management of a client’s finances, including investment management, tax planning, estate planning, and retirement planning. The goal is to grow and protect wealth over the long term while meeting the client’s financial objectives for his retirement lifestyle.

The Importance of Wealth Management

Comprehensive Financial Planning

Wealth management offers a comprehensive approach to financial planning. Instead of addressing individual financial needs in isolation, wealth management considers your entire financial picture. This includes assessing your assets, liabilities, income, and expenses to create a personalized financial plan. According to a study by Vanguard, individuals who work with a financial advisor typically see an additional 3% in net returns on their investments, thanks to strategic financial planning and disciplined decision-making. Emile Mehanna, CEO of the Arab Finance Corporation, emphasizes the importance of wealth management in achieving financial security: “Wealth management is not just about growing your assets; it’s about protecting your financial future. In today’s volatile economic environment, having a comprehensive financial plan is more important than ever.”

Investment Management

One of the core components of wealth management is investment management. Wealth managers help you build and manage a diversified investment portfolio tailored to your risk tolerance, time horizon, and financial goals. Research by Dalbar shows that the average investor significantly underperforms compared to the market, often due to emotional decision-making and poor timing. Wealth managers provide the expertise and discipline needed to avoid these pitfalls, potentially leading to better long-term returns.

Retirement Planning

Retirement planning is a critical aspect of wealth management. With life expectancy increasing and the future of social security uncertain, planning for a secure retirement is more important than ever. A survey by the Employee Benefit Research Institute found that nearly 40% of workers feel they are not on track for a comfortable retirement. Wealth managers can help you develop a retirement plan that ensures you have enough income to maintain your lifestyle in retirement. This includes selecting the right retirement accounts, optimizing contributions, and creating a withdrawal strategy that minimizes taxes.

Estate Planning

Estate planning is another key element of wealth management. It involves preparing for the transfer of your assets to your heirs or beneficiaries upon your death. A well-structured estate plan can minimize estate taxes, avoid probate, and ensure that your assets are distributed according to your wishes.

Private Banking

For high-net-worth individuals, private banking services are often a significant component of wealth management. Private banking offers personalized financial services, including specialized lending, investment management, and exclusive financial products. These services are tailored to meet the unique needs of wealthy clients and often include a dedicated relationship manager who coordinates all aspects of the client’s financial affairs.

The Role of a Wealth Manager

A wealth manager acts as a financial advisor, investment manager, and estate planner all in one. They take a holistic view of your finances and work with you to develop a comprehensive strategy that aligns with your goals. This involves:

- Personalized Financial Advice: Wealth managers provide tailored advice based on your financial situation, goals, and risk tolerance. This personalized approach ensures that your financial plan is aligned with your long-term objectives.

- Coordination of Financial Services: Wealth managers coordinate various financial services, including investment management, tax planning, estate planning, and retirement planning. This integrated approach ensures that all aspects of your financial life work together seamlessly.

- Ongoing Monitoring and Adjustments: Wealth management is not a one-time event but an ongoing process. Wealth managers continuously monitor your financial situation and make adjustments as needed to ensure that your financial plan remains on track.

The Benefits of Wealth Management

“Our clients often face complex financial challenges that require specialized knowledge and expertise. A wealth manager can provide the guidance and support needed to make informed decisions and avoid costly mistakes.”, stated Mehanna. And he added: “Every client is unique, with their own financial goals and challenges. Wealth management is about creating a customized strategy that meets the individual needs of each client, ensuring they achieve their financial objectives.”

Peace of Mind

One of the most significant benefits of wealth management is peace of mind. Knowing that your financial affairs are in order and that you have a plan in place for the future can reduce stress and anxiety. A study by the American Psychological Association found that money is the top source of stress for most Americans. By working with a wealth manager, you can alleviate some of this stress and focus on other important aspects of your life.

Expertise and Experience

Wealth managers bring a wealth of expertise and experience to the table. They have a deep understanding of financial markets, tax laws, and estate planning strategies. This knowledge allows them to provide valuable insights and recommendations that can help you achieve your financial goals.

Customized Strategies

Wealth management offers customized strategies that are tailored to your unique needs and goals. Whether you’re focused on growing your wealth, preserving your assets, or planning for retirement, a wealth manager can develop a strategy that aligns with your objectives.

Long-Term Financial Security

Ultimately, the goal of wealth management is to provide long-term financial security. By developing a comprehensive financial plan and implementing it with discipline and expertise, wealth managers help you build and preserve your wealth over time.

Wealth management is essential for anyone looking to secure their financial future. With the right wealth management strategy in place, you can enjoy peace of mind, knowing that your financial future is in good hands.

In a world where financial markets are unpredictable and tax laws are complex, wealth management offers a comprehensive solution to managing your finances. By working with a wealth manager, you can ensure that all aspects of your financial life are aligned with your long-term goals, allowing you to focus on what matters most to you. As Emile Mehanna aptly puts it, “Wealth management is not just about today; it’s about securing your financial future for tomorrow.”

Discover How We Can Help You Grow

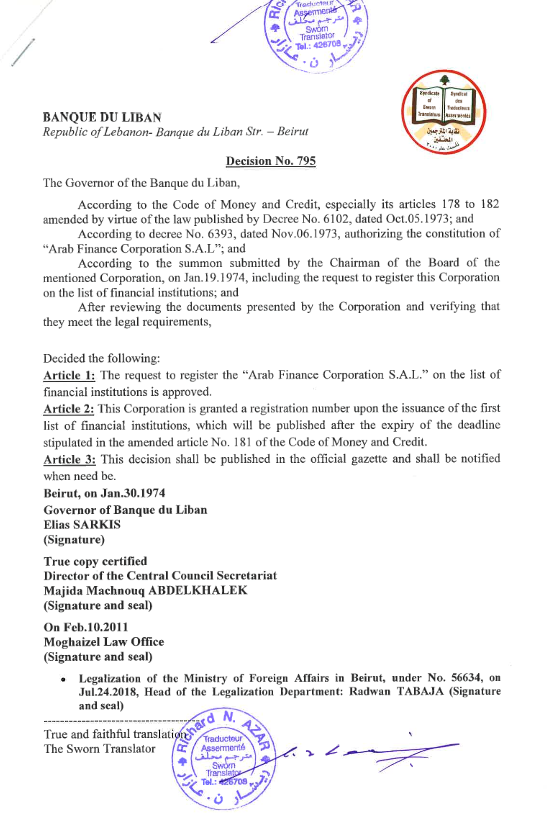

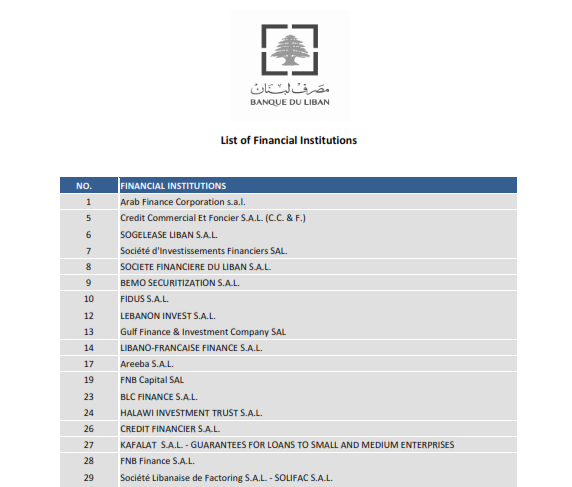

Established in 1974, Arab Finance Corporation (AFC) is the first financial institution registered in Lebanon. We hold the number one on Banque du Liban’s list of financial institutions. For half a century now, we have been offering a wide range of financial services to private and institutional clients in Lebanon, the region and worldwide. Our services range from financial markets, corporate finance advisory, asset management, to online trading services.