Why Is It Important to Open a Trading Account?

Introduction

In today’s interconnected world, online trading solutions have revolutionized the way individuals and institutions engage with the global markets. With the rise of digital platforms and advancements in technology, investors have unparalleled access to diverse asset classes such as stocks and forex trading.

But why is it essential to have access to an online trading platform and open a trading account, and how can it impact your financial journey? In this article, we delve into the benefits of online trading, the different types of trading accounts, and why establishing one is a crucial step toward financial success.

The Role of a Trading Account in Modern Financial Markets

A trading account serves as a gateway to the financial markets, allowing investors to buy and sell assets easily. With a surge in interest in online trading solutions, more and more individuals are embracing the idea of managing their own portfolios, empowered by real-time market data and sophisticated trading platforms. Emile Mehanna, CEO of Arab Finance Corporation, emphasizes the importance of staying ahead in today’s financial landscape, stating, “As markets evolve, so do the tools we use to navigate them. Having access to a reliable online trading platform in Lebanon is crucial for anyone looking to take control of their investments.”

As financial markets become increasingly volatile and influenced by global events, investors need to employ effective trading strategies. Whether it’s short-term gains through day trading or long-term capital growth through strategic investments, having a trading account allows flexibility and accessibility. Today, investors in Lebanon and beyond are using platforms to engage with a broad spectrum of markets, from equities to forex trading.

Why Now is the Best Time to Start Trading

With over 30% of trades in the global financial market happening online, it’s clear that digital platforms are reshaping how people interact with financial markets. According to a 2022 report from Statista, global online trading volumes have grown by more than 25% annually, fueled by increased participation from retail investors. “The democratization of finance means that anyone, anywhere, can now engage with the markets and have access to online trading solutions. This accessibility is one of the main reasons why more people should consider opening a trading account,” says Emile Mehanna.

In Lebanon, the financial landscape has shifted significantly, with more emphasis on online trading. This growth is attributed to several factors, including increased internet penetration, the rise of mobile trading apps, and the growing appeal. A trading account provides access to real-time information, advanced charting tools, and immediate trade execution—benefits that weren’t available to the average investor just a decade ago.

Types of Trading Accounts

Before embarking on your trading journey, it’s essential to understand the different types of accounts available and their specific uses. Each account serves distinct purposes, depending on the assets you wish to trade and your financial goals.

- No Leverage Account

It is the simplest form of trading account, where you can only trade with the capital you have on hand. It doesn’t allow margin trading, making it a safer option for those new to trading. It is particularly suitable for individuals who wish to invest in stocks or bonds without any leverage. - Margin Account

In a margin account, investors can borrow funds from their broker to purchase more securities than they could with their available capital. While this account type allows for increased buying power, it also comes with added risks, particularly in volatile markets such as forex trading.

Navigating Volatility with the Right Trading Strategies

Understanding and employing effective trading strategies is vital for success in global markets. The right strategy will depend on your risk tolerance, investment goals, and the time you can commit to monitoring the markets.

- Day Trading

Popular in forex trading, day trading involves buying and selling securities within a single trading day to profit from short-term price fluctuations. This strategy requires discipline, real-time data, and swift decision-making. - Swing Trading

Unlike day trading, swing trading seeks to capture gains over several days or weeks, exploiting market trends and technical analysis. It’s often used for trading equities. - Position Trading

Position trading is a longer-term strategy, where traders hold onto their investments for months or even years. This approach is ideal for those interested in growth assets like stocks, or more stable investments like government bonds. - Diversification

One of the most effective trading strategies is diversification—spreading investments across multiple asset classes to mitigate risk. This could include a mix of stocks, forex trading, and even alternative assets.

The Impact of Technology on Online Trading Solutions

The shift toward online trading solutions is driven largely by technological advancements. Modern trading platforms offer user-friendly interfaces, advanced tools, and educational resources that were once only available to professional traders. These platforms empower investors to manage their portfolios, execute trades swiftly, and stay informed with real-time market data.

Arab Finance Corporation empowers local investors by providing access to global markets, enabling them to diversify their portfolios and explore opportunities beyond domestic boundaries. Beyond this access, a quality trading platform also offers comprehensive advisory services and research support, delivering expert guidance and in-depth market analysis.

These resources are crucial for investors to make informed decisions, develop effective trading strategies, and stay ahead of market trends. With such support, Arab Finance Corporation ensures that investors are well-equipped to navigate the complexities of the financial landscape with confidence.

The Future of Trading: What Lies Ahead?

As we look toward the future, the integration of AI and machine learning into online trading solutions promises to make the investment landscape even more dynamic. Predictive algorithms and automated trading systems will soon become commonplace, allowing investors to make data-driven decisions with greater accuracy.

Moreover, a 2023 report from Bloomberg highlighted that global stock markets are expected to see a 10% growth annually over the next five years, driven by technological advancements, emerging industries, and increased investor participation. Whether you’re a seasoned trader or a beginner, now is the perfect time to explore the opportunities presented by this rapidly evolving financial landscape. Whether you’re a seasoned trader or a beginner, now is the time to explore the opportunities presented by this evolving financial ecosystem.

Conclusion

Opening a trading account is not just about accessing the markets—it’s about taking control of your financial future. With the right trading strategies and a trusted partner like Arab Finance Corporation, you can navigate the complexities of the global markets and seize new opportunities.

Whether you’re looking to trade stocks, or engage in forex trading, the first step is to establish a reliable trading account. As Emile Mehanna aptly puts it, “In an ever-changing financial world, the right tools and strategies can make all the difference. A trading account is your first step toward unlocking that potential.”

Discover How We Can Help You Grow

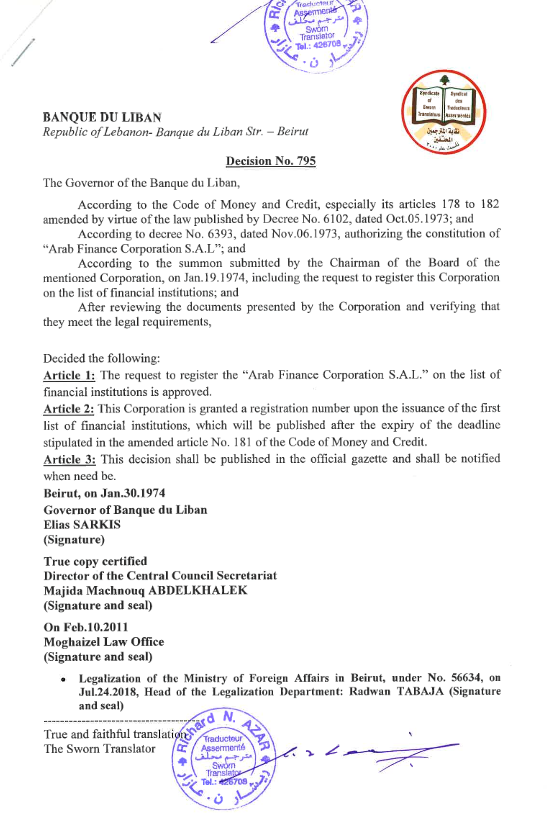

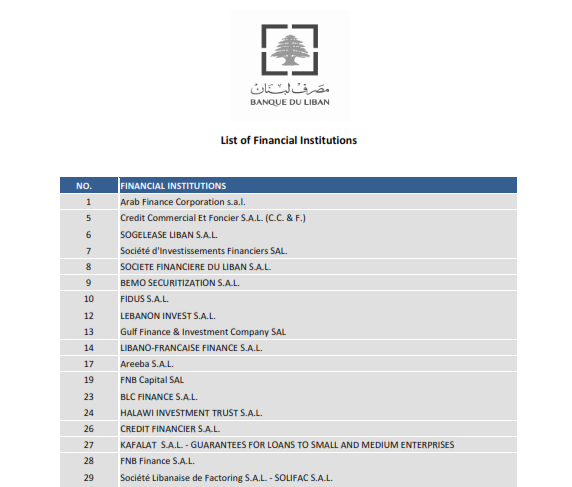

Established in 1974, Arab Finance Corporation (AFC) is the first financial institution registered in Lebanon. We hold the number one on Banque du Liban’s list of financial institutions. For half a century now, we have been offering a wide range of financial services to private and institutional clients in Lebanon, the region and worldwide. Our services range from financial markets, corporate finance advisory, asset management, to online trading services.