Are Online Trading Platforms Safe?

Introduction

However, as these platforms grow in popularity, so do concerns about their safety and security. In this article, we will explore whether online trading platforms are safe, the measures in place to protect users, and how traders can safeguard their investments.

The advent of online trading platforms has revolutionized the financial industry, making trading more accessible to the average investor. With the click of a button, anyone can engage in online stock trading, forex trading, cryptocurrency trading services, and more.

Understanding Online Trading Platforms

Online trading platforms are sophisticated software applications that enable investors to engage in buying and selling securities, including stocks, commodities, and currencies, via the internet.

These platforms act as intermediaries between investors and the financial markets, providing the tools and resources necessary to make informed trading decisions. They facilitate various types of trading, such as online stock trading, forex trading, options trading, and more.

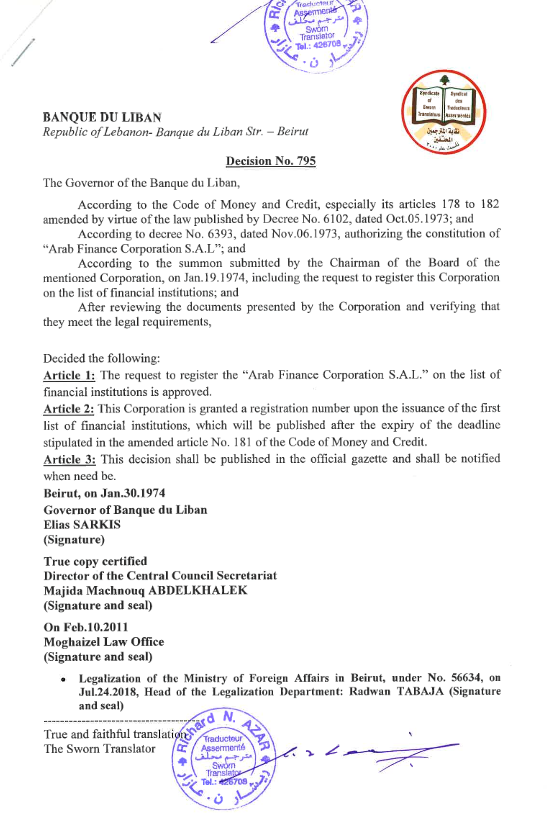

“The introduction of online trading platforms has revolutionized the way trading is conducted, democratizing access to financial markets and providing a level playing field for all investors”, stated Emile Mehanna, CEO of Arab Finance Corporation. As a matter of fact, here’s how these platforms have transformed the trading landscape

- Real-Time Data Access: Online trading platforms provide users with real-time market data, enabling them to make informed decisions quickly. Advanced analytical tools and charts are readily available, offering insights that were previously accessible only to professionals.

- Lower Costs: Many platforms offer commission-free trades, significantly reducing the cost of trading. Even those that charge fees do so at a fraction of traditional broker costs.

- Speed and Efficiency: Trades can be executed almost instantaneously with a few clicks, allowing investors to capitalize on market opportunities as they arise. This speed is particularly beneficial in volatile markets where timing is crucial.

- Enhanced Accessibility: Online trading platforms have made it possible for anyone with an internet connection to participate in the financial markets. This accessibility has opened up trading to a broader demographic, including younger and more tech-savvy investors.

- Diverse Trading Options: Modern platforms offer a wide range of trading services, from online stock trading and forex trading platforms to derivatives trading services and online options trading. This variety allows investors to diversify their portfolios and explore different investment strategies.

Key Safety Concerns with Online Trading Platforms

One of the primary concerns with online trading platforms is the risk of cyber-attacks. Hackers employ various methods to infiltrate systems, steal personal information, and gain unauthorized access to financial accounts. These security risks can be categorized into several types:

Hacking: Cybercriminals use sophisticated techniques to break into trading platforms and individual accounts. Once inside, they can steal sensitive data such as login credentials, personal identification details, and financial assets. This stolen information can then be sold on the dark web or used to commit further fraud.

Phishing Scams: Phishing is a common tactic where fraudsters send deceptive emails or messages that appear to come from legitimate trading platforms. These messages often contain links to fake websites designed to capture user credentials. Once users enter their information, it is harvested by the scammers, who can then access the real trading accounts.

Malware and Ransomware: Malicious software can infect users’ devices, providing hackers with remote access to their systems. Ransomware can lock users out of their own data until a ransom is paid, while other malware types can silently steal information over time.

In addition to security risks, online trading platforms pose several financial risks that users need to be aware of:

Hidden Fees: Many platforms advertise low or no-commission trading, but they may have other hidden fees that can add up over time. These can include fees for account maintenance, inactivity, data access, or higher costs for specific types of trades. Users should thoroughly review the fee structure of any platform before committing to it.

Market Manipulation: In some cases, unscrupulous entities may manipulate markets to their advantage, a practice that can severely impact retail traders. This can involve “pump and dump” schemes in which the price of a stock is artificially inflated, leading traders to buy in at high prices, only for the manipulators to sell off their shares and cause the price to plummet.

Volatile Markets: The financial markets are inherently volatile, and significant losses can occur rapidly. This risk is particularly pronounced in markets like cryptocurrency trading services and forex trading platforms, where prices can fluctuate wildly within short periods. Novice traders are often unprepared for such volatility, leading to substantial financial losses.

Insufficient Regulation: Not all online trading platforms are subject to rigorous regulatory oversight. Platforms operating in jurisdictions with lax regulations may not adhere to the same standards of transparency and fairness, increasing the risk of fraud and market manipulation.

“While online trading platforms offer numerous benefits, including accessibility and efficiency, they also come with significant security and financial risks. Investors must remain vigilant and informed, ensuring they choose reputable, regulated platforms and understand the potential pitfalls. By being aware of these risks and taking appropriate precautions, traders can better protect their investments in the digital trading world.”, commented Mehanna.

Security Measures Implemented by Reputable Platforms

Reputable online trading platforms employ advanced encryption technologies to safeguard user data. Encryption transforms readable data into an encoded format that can only be deciphered by authorized parties. This ensures that sensitive information, such as personal details and financial transactions, remains confidential and secure from unauthorized access. Examples are: SSL (Secure Socket Layer), TLS (Transport Layer Security), and End-to-End Encryption.

As for the authentication processes, they are essential for verifying the identity of users and preventing unauthorized access to trading accounts. Reputable platforms implement multiple layers of authentication to enhance security.

Choosing the Right Platform: What to Look For

When selecting an online trading platform, it is essential to consider several factors:

- Regulation: Ensure the platform is regulated by a jurisdiction.

- User Reviews and Reputation: Research user reviews and the platform’s reputation in the industry.

- Security Features: Look for platforms that offer robust security features.

“Investors must prioritize platforms that have a strong track record of security and/or related to reputable companies in the industry,” says the CEO of AFC. “Our priority is to ensure our clients’ data and investments are safeguarded against potential threats.”

Best Practices for Traders to Enhance Security

Create Strong Passwords: Use complex passwords that include a mix of letters, numbers, and special characters. Avoid using easily guessable information, such as birthdays or simple sequences.

Regularly Update Software: Ensure that all software, including trading platforms and antivirus programs, is regularly updated to protect against the latest security threats.

Recognize and Avoid Phishing Scams: Be wary of emails or messages that ask for personal information or prompt you to click on suspicious links. Always verify the source before providing any details.

Conclusion

In conclusion, while online trading platforms offer numerous advantages, they also present various risks. By choosing regulated and reputable platforms, utilizing robust security features, and following best practices, traders can significantly enhance their safety. Approach online trading with informed caution and the right knowledge to protect your investments.

To learn more about safe trading practices or to consult with AFC experts for personalized advice, visit our website or contact our support team.

Discover How We Can Help You Grow

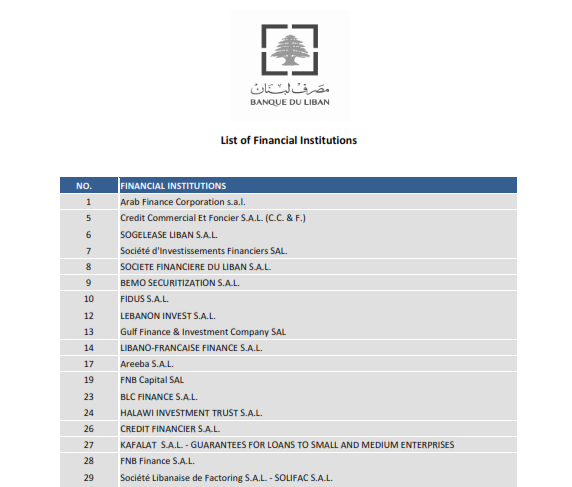

Established in 1974, Arab Finance Corporation (AFC) is the first financial institution registered in Lebanon. We hold the number one on Banque du Liban’s list of financial institutions. For half a century now, we have been offering a wide range of financial services to private and institutional clients in Lebanon, the region and worldwide. Our services range from financial markets, corporate finance advisory, asset management, to online trading services.