Mastering the Basics: Key Terminology and Strategies for New Online Traders

Introduction

Venturing into the realm of online trading can be both exhilarating and overwhelming for newcomers eager to explore the financial markets. With technological advancements making it easier than ever to trade from the comfort of your home, understanding the basics is crucial to gaining confidence and success.

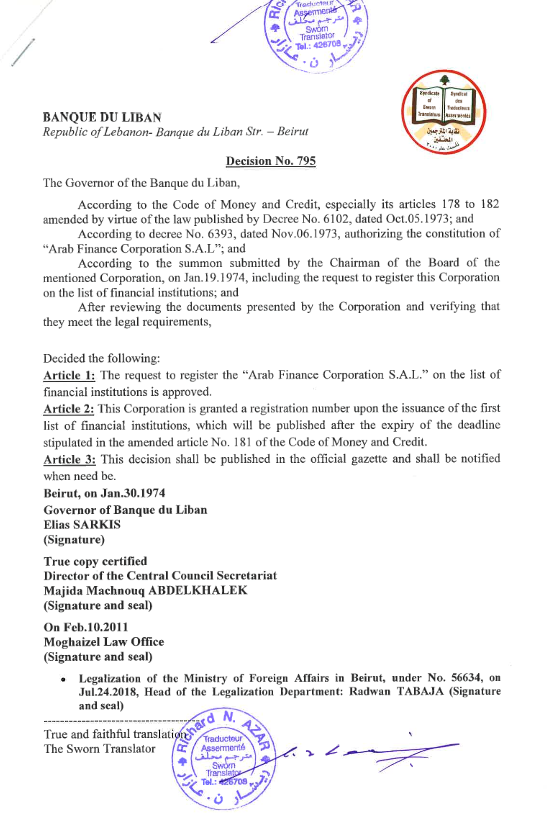

“Online trading offers unparalleled access to financial markets, but understanding the fundamentals is essential for anyone looking to succeed,” says Emile Mehanna, CEO of Arab Finance Corporation. “At AFC, we believe that knowledge and strategic planning are the foundation of confident, well-informed trading decisions.”

We will walk you through essential terminology and strategies that are key to navigating the diverse landscape of online trading, from stocks to Forex trading. We’ll also discuss how to select a reliable online trading platform and read market trends to make informed decisions. Whether you’re an entrepreneur or a student stepping into the world of global markets, mastering these fundamentals will lay a solid foundation for your trading journey.

Understanding Financial Markets

Understanding financial markets is a crucial first step for anyone entering online trading. These markets are platforms where various assets, such as stocks, currencies, and commodities, are bought and sold.

Each market operates under specific rules and can be influenced by countless factors, including economic indicators, political events, and market sentiment. For instance, the stock market allows you to buy shares of publicly traded companies, offering opportunities for growth through capital gains and dividends.

Meanwhile, Forex trading involves the exchange of currencies, making it one of the largest and most liquid markets globally. By grasping the intricacies of these markets, you can make informed decisions and develop effective trading strategies. Choosing the right market depends on your interests, risk tolerance, and the resources available on different online trading platforms.

Understanding these foundational elements will enhance your ability to navigate the complex world of financial markets with confidence.

Key Terminology for Beginners

For beginners in online trading, familiarizing yourself with key terminology is essential. Terms like “bull market” and “bear market” describe market trends—bull markets indicate rising prices, while bear markets are characterized by falling prices.

Understanding these can help you make strategic decisions.

- “Leverage” allows traders to control a larger position with a smaller amount of capital, which can amplify gains but also increase risk.

- “Spread” refers to the difference between the buying and selling price of an asset, impacting your trading costs.

- Another crucial term is “margin,” which is the collateral required to open and maintain a leveraged position.

- Knowing the meaning of “stop-loss order” is vital, as it helps limit potential losses by automatically selling an asset when it hits a predetermined price.

By mastering this terminology, you can navigate online trading platforms with greater ease and confidence, enhancing your trading strategies and decision-making process.

Types of Tradable Assets – Exploring Stocks and Forex

Stocks and Forex represent two of the most popular avenues for online trading. Stocks allow you to purchase shares of publicly traded companies, essentially giving you a stake in their success and potential profits through dividends and capital appreciation.

Investing in stocks can be rewarding but requires careful analysis of company performance and market conditions. On the other hand, Forex trading involves the buying and selling of currencies in the global forex market. It’s the largest financial market, with high liquidity, operating 24 hours a day.

Forex trading is appealing due to its potential for quick profits and the influence of macroeconomic factors. However, it also demands an understanding of currency pairs, economic indicators, and geopolitical events. Both stocks and Forex offer unique opportunities and challenges, and selecting between them should align with your trading strategies, risk tolerance, and the resources offered by your chosen online trading platform.

Developing Trading Strategies

A solid trading strategy is essential for navigating the complexities of online trading. It serves as a roadmap, guiding your investment decisions and helping to mitigate risks.

A well-crafted strategy considers your financial goals, risk tolerance, and market conditions, enabling you to make informed choices rather than acting on impulse. It incorporates key elements like entry and exit points, position sizing, and risk management techniques to protect your capital.

“A solid trading strategy is not just about profits; it’s about maintaining discipline and making data-driven decisions,” explains Emile Mehanna. “With the right tools and a thoughtful approach, traders can effectively navigate market shifts and achieve sustainable growth.”

Without a strategic approach, traders may fall prey to emotional decision-making, leading to potential losses. Data shows that 80% of day traders quit within the first two years, emphasizing the importance of a robust and realistic trading strategy to manage expectations and limit emotional decisions.

Additionally, a solid strategy allows for consistent evaluation and adjustment, fostering adaptability as market dynamics shift. Whether you’re trading stocks, Forex… having a robust plan can enhance your confidence and discipline. Utilizing a strategy also enables you to use analytics and data-driven insights, essential for optimizing your performance on various online trading platforms in today’s financial markets.

Tips for Crafting Effective Plans

Crafting an effective trading plan is crucial for success in online trading:

- Start by setting clear, achievable goals that align with your financial objectives and risk appetite.

- Define your trading style—whether you prefer day trading, swing trading, or long-term investing—to suit your lifestyle and market experience.

- Integrate risk management techniques, such as stop-loss orders and position sizing, to safeguard against significant losses.

- Ensure your plan includes a detailed analysis process, leveraging technical and fundamental analysis to inform your decisions.

- Regularly review and adjust your plan based on market trends and personal performance, fostering an adaptive approach.

- It’s also beneficial to document your trades, noting what worked and what didn’t, to refine your strategy over time.

- Utilize online trading platforms’ tools and resources to enhance your analysis and execution.

By following these tips, you can develop a comprehensive plan that supports disciplined, informed, and strategic trading in financial markets.

Choosing an Online Trading Platform – Evaluating Platform Reliability

Evaluating the reliability of an online trading platform is a critical step in ensuring a secure and efficient trading experience.

In 2022, the Federal Trade Commission (FTC) reported that online trading scams accounted for losses exceeding $1 billion, a stark reminder of the importance of using secure, regulated platforms.

- Start by researching the platform’s reputation, and looking for user reviews and ratings to gauge overall satisfaction.

- Verify that the platform is regulated by reputable financial authorities, which adds a layer of security and compliance.

- Assess the technology infrastructure for reliability and uptime, as frequent outages can disrupt trading activities.

- Examine the platform’s security measures, such as encryption and two-factor authentication, to protect your personal and financial information.

- Additionally, consider the quality of customer support, as prompt assistance can be invaluable during technical issues or market fluctuations.

- Evaluate the range of tools and resources available, ensuring they align with your trading strategies and needs.

By thoroughly assessing these factors, you can choose a reliable online trading platform that provides a stable and secure environment for engaging in financial markets and executing trades effectively.

Features to Look for When Selecting an Online Trading Platform

It’s essential to consider key features that can enhance your trading experience.

- First, evaluate the user interface—intuitive designs and easy navigation can significantly impact your efficiency and satisfaction.

- Access to comprehensive research tools and real-time market data is crucial for informed decision-making and developing effective trading strategies.

- Look for platforms offering a wide range of tradable assets, including stocks, Forex… to diversify your portfolio.

- Additionally, advanced charting tools and technical analysis capabilities can support in-depth market analysis.

- Mobile compatibility is another valuable feature, allowing you to trade on the go and keep track of your investments anytime.

- Transparent fee structures and competitive pricing can affect your overall profitability, so assess these carefully.

- Lastly, robust educational resources and tutorials can be beneficial, especially for new traders looking to expand their knowledge and skills. These features collectively ensure a comprehensive and supportive trading environment.

In 2022, the Federal Trade Commission (FTC) reported that online trading scams accounted for losses exceeding $1 billion, a stark reminder of the importance of using secure, regulated platforms.

Navigating Market Trends

Analyzing global markets is fundamental for making well-informed trading decisions. Global markets are interconnected, meaning events in one region can influence markets worldwide.

Begin by monitoring economic indicators such as GDP growth rates, unemployment figures, and inflation rates, as these can signal economic health and potential market movements.

Stay updated on geopolitical developments, including elections, trade agreements, and conflicts, which can cause significant market volatility.

Utilize financial news sources and market analysis reports to gain insights into global trends and sentiment.

Also, pay attention to central bank policies and interest rate changes, as these can impact currency values and stock markets.

Incorporating global market analysis into your trading strategies helps you anticipate shifts and adapt accordingly. Online trading platforms often provide tools and resources to track these global indicators, enabling you to stay informed and make smarter trading choices in the ever-evolving landscape of financial markets.

Discover How We Can Help You Grow

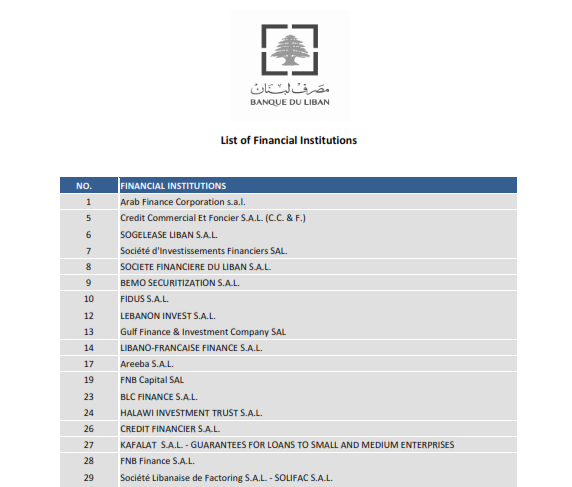

Established in 1974, Arab Finance Corporation (AFC) is the first financial institution registered in Lebanon. We hold the number one on Banque du Liban’s list of financial institutions. For half a century now, we have been offering a wide range of financial services to private and institutional clients in Lebanon, the region, and worldwide. Our services range from financial markets and corporate finance advisory to asset management and online trading services.