What is Wealth Management?

Introduction

Wealth management is a specialized service designed to enhance and protect an individual’s financial health and assets. Emile Mehanna, CEO of AFC, defines it: “Wealth management is not just about having money; it’s about managing money in a way that aligns with your goals and future needs.”

Wealth management is an essential strategy for achieving long-term financial security and peace of mind. By enlisting professional guidance, individuals can benefit from optimized investment strategies tailored to their unique financial circumstances and goals. A comprehensive wealth management plan not only helps in maximizing returns but also in mitigating risks associated with volatile markets.

Furthermore, it ensures that all financial decisions are aligned with the individual’s life stages and future aspirations, thus providing a clear path toward financial stability and growth. This holistic approach to managing wealth not only secures financial resources but also offers the invaluable benefit of mental and emotional ease, knowing that one’s financial future is in capable hands.

This strategy is vital for anyone aiming to achieve financial security and meet specific life goals.

The Basics of Wealth Management

Wealth management is a general approach that integrates various financial services to meet the needs of affluent clients. It is more comprehensive than simple investment advice, encompassing financial and investment advice, tax services, retirement planning, and legal or estate planning.

Financial planning offers a broad overview aimed at setting long-term financial goals, whereas wealth management includes more complex services like estate planning and private banking, tailored for wealthy clients or those with intricate financial situations.

Key Components of Wealth Management

Investment Management: Investment management is foundational in wealth management, focusing on risk management and portfolio diversification. According to the Global Wealth 2019 report by Boston Consulting Group, diversified portfolios better withstand market volatility, enhancing asset growth over time.

Estate Planning: Estate planning is crucial for ensuring your assets are passed on as intended while minimizing tax liabilities. Studies show that proper estate planning can reduce estate taxes by up to 50%, depending on local laws and the complexity of the estate.

Tax Planning: Effective tax planning strategies can legally reduce taxation levels significantly. In the US, the IRS reports that strategic tax planning saves millions annually for U.S. taxpayers. And it is the same case in all countries; hence the importance of this component in wealth management.

Retirement Planning: With the average retirement age rising and life expectancy increasing globally, effective retirement planning is more crucial than ever. A study by the World Bank highlights that without adequate retirement planning, individuals may face a significant drop in their standard of living post-retirement.

The Wealth Management Process

Initial Assessment: This involves a detailed examination of the client’s current financial situation, future aspirations, risk tolerance and investment time horizon, setting the stage for all subsequent financial strategies.

Strategy Development: The wealth manager devises a customized plan based on the initial assessment to address the specific financial needs and goals of the client.

Implementation: The strategies are implemented using various financial tools and products to maximize wealth growth.

Ongoing Monitoring and Adjustment: Given the dynamic nature of finance, ongoing strategy reviews and adjustments are crucial. The financial markets’ volatility necessitates frequent reviews to align with new economic conditions or personal circumstances.

Who Needs Wealth Management?

Wealth management typically targets high-net-worth individuals, families, and businesses. Emile Mehanna states, “Our clients include entrepreneurs and multi-generational families, each looking for personalized strategies to protect and enhance their wealth.”

According to Capgemini’s World Wealth Report 2020, there are over 19.6 million high-net-worth individuals globally, highlighting the broad market for wealth management services.

Choosing a Wealth Manager

What to Look for in a Wealth Manager: Choosing the right wealth manager is critical. Clients should look for advisors whose investment philosophy and interpersonal style match their own.

Importance of Credentials and Experience: Look for credentials like Financial Risk Manager (FRM) or Chartered Market Technician (CMT), which signify a professional’s expertise and ethical standards.

Understanding Fee Structures: Wealth managers can operate on fee-based or commission-based structures. It’s crucial to understand these to choose the best fit for your financial needs.

Trends and Innovations in Wealth Management

Technological advancements such as robo-advisors and AI-driven analytics are making wealth management more accessible and personalized.

Sustainable and ESG investing is gaining traction, reflecting a shift towards investments that offer financial returns alongside social and environmental benefits.

Challenges of Wealth Management

Managing wealth effectively involves navigating a complex landscape of financial challenges. These obstacles can significantly impact an individual’s ability to preserve and grow their wealth over time. Here are some of the common challenges faced in wealth management:

Market Volatility: Market volatility refers to the fluctuations in the prices of investments within short periods. It is one of the most immediate concerns for wealth managers and investors alike. Volatility can be driven by economic data, geopolitical events, changes in government policies, and market sentiment. Managing this risk involves understanding asset allocation, diversification strategies, and sometimes timing the market, which can be highly challenging even for seasoned investors.

Tax Implications: Taxes can diminish the overall returns from investments significantly if not managed properly. Different investment vehicles and income sources have varying tax treatments. Understanding these nuances—such as the difference between long-term and short-term capital gains, the impact of estate taxes, or the benefits of tax-deferred accounts—requires sophisticated planning and ongoing management to optimize tax liability.

Changing Financial Goals: An individual’s financial goals typically evolve over time due to changes in personal circumstances, such as marriage, the birth of children, career changes, or retirement. Each stage of life may require adjustments in investment strategies. For instance, younger investors may focus on growth, while older individuals might prioritize capital preservation and income. Adapting to these shifting goals without compromising financial security is a critical challenge.

Risk Management: Different types of risks—market risk, credit risk, liquidity risk, and operational risk—can affect investments. Effective risk management entails identifying these risks, assessing their potential impact, and developing strategies to mitigate them. This often involves diversifying investments across various asset classes, industries, and geographical regions.

Regulatory Compliance: Financial markets are heavily regulated, and the rules can change. Keeping up with these regulations is essential to avoid penalties and ensure that investment strategies are both effective and legal. Compliance must be managed across different jurisdictions, especially for investors with international holdings.

Information Overload: The large volume of financial information available today can be overwhelming. Deciding what information is relevant and what can be ignored is crucial. The ability to sift through data, analyze trends, and make informed decisions is essential but can be very challenging given the rapid pace at which market conditions change.

Emotional Decision-Making: Wealth management often involves high stakes, which can lead to emotional decision-making. Fear and greed are powerful emotions that can cause individuals to make rash decisions—such as panic selling during a market downturn or excessively risky investments during a bull market. Learning to maintain a disciplined approach in investment strategy, despite emotional impulses, is crucial.

Succession Planning: For individuals and families with significant wealth, planning how this wealth will be passed on to future generations is a vital but complex issue. It involves legal considerations, tax planning, and often, family dynamics. Ensuring a smooth transition requires careful planning and clear communication.

Addressing these challenges often requires a combination of deep financial knowledge, strategic foresight, and personal discipline. That’s why, many individuals choose to work with professional wealth managers who can provide expertise, resources, and an objective perspective to help navigate these complexities effectively.

Conclusion

Wealth management is an essential, complex service that helps individuals effectively manage and grow their wealth. Emile Mehanna, the CEO of AFC, emphasizes the personalized nature of their service, encouraging those interested in securing their financial future to explore the unique, tailored strategies that wealth management can offer. He states, “Every individual’s financial situation is unique, necessitating a tailored strategy meticulously crafted to meet specific goals and challenges. Schedule a consultation with us at AFC to discover how our personalized approach to wealth management can assist you in achieving your financial and life goals.”

This overview underscores the importance of professional wealth management in maintaining and enhancing financial health in a rapidly changing world.

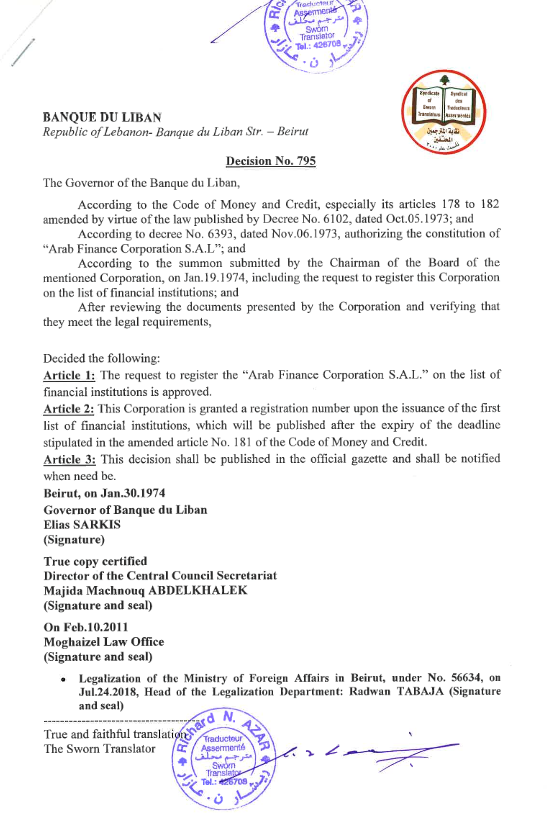

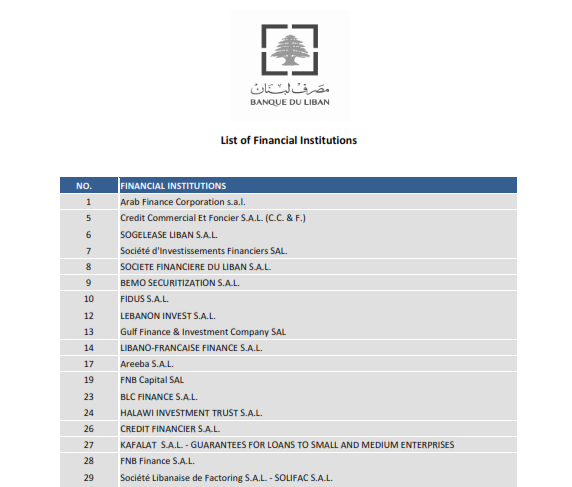

Discover How We Can Help You Grow

Established in 1974, Arab Finance Corporation (AFC) is the first financial institution registered in Lebanon. We hold the number one on Banque du Liban’s list of financial institutions. For half a century now, we have been offering a wide range of financial services to private and institutional clients in Lebanon, the region and worldwide. Our services range from financial markets, corporate finance advisory, asset management, to online trading services.